Digital Rupee (e₹-R) is the central bank digital currency (CBDC) of India backed by RBI. It is a digital form of the Indian Rupee.

In a digital Rupee system, the Reserve Bank of India (RBI) would issue and manage the digital currency, while participating banks would act as intermediaries to enable transactions between consumers and businesses.

Digital Rupee would be stored in digital wallets and could be used for peer-to-peer transactions, online purchases, and other electronic transactions.

The government of India has recently launched its pilot version only for the retail segment on 1st December 2022.

This pilot phase has been initiated in the selected cities – Mumbai, New Delhi, Bangalore, and Bhubaneswar. Gradually it will get extended in other cities as well.

Initially, only four banks are involved in the pilot phase – State Bank of India, ICICI Bank, Yes Bank, and IDFC First Bank.

The government of India started this digital rupee pilot program with a closed user group (CUG) which includes merchants and customers.

Banks have informed the users who have been selected in the closed user group (CUG) to participate in this pilot phase via SMS and email.

How Digital Rupee is different from physical Cash/Coins?

Digital rupee is similar to the physical rupee (Cash & Coins) we hold in our pockets.

The only difference is that; instead of holding it in our pocket, we will be holding it in the digital wallet offered by the bank.

How to do transactions in Digital Rupee (e-rupee)?

At present, only the closed user group (CUG) participants can do transactions in digital rupee.

Here’s a step-by-step guide to do transactions in digital rupee –

Step 1: Register for Digital Wallet (e-wallet)

To store and transact in digital rupee, you need to open a digital wallet. This can be done through a participating bank only.

Every bank has its own e-rupee wallet App which can be downloaded from the play store.

After downloading the e-rupee App, you have to fill required details and verify the account to finish the registration process.

Step 2: Add Funds to your e-wallet

Once you have a digital wallet, you’ll need to add funds to it.

This can be done by transferring funds from your bank account. For this bank provide two options.

You can transfer money into your digital wallet,

a) from the account linked to the bank OR

b) from various UPI Apps

It’s quite similar to the way we add money to our Paytm wallet.

You can also withdraw money from the same digital wallet whenever you want.

Step 3: Make a Transaction

Transaction in Digital rupee can be done between Person to Person (P2P) and Person to Merchant (P2M).

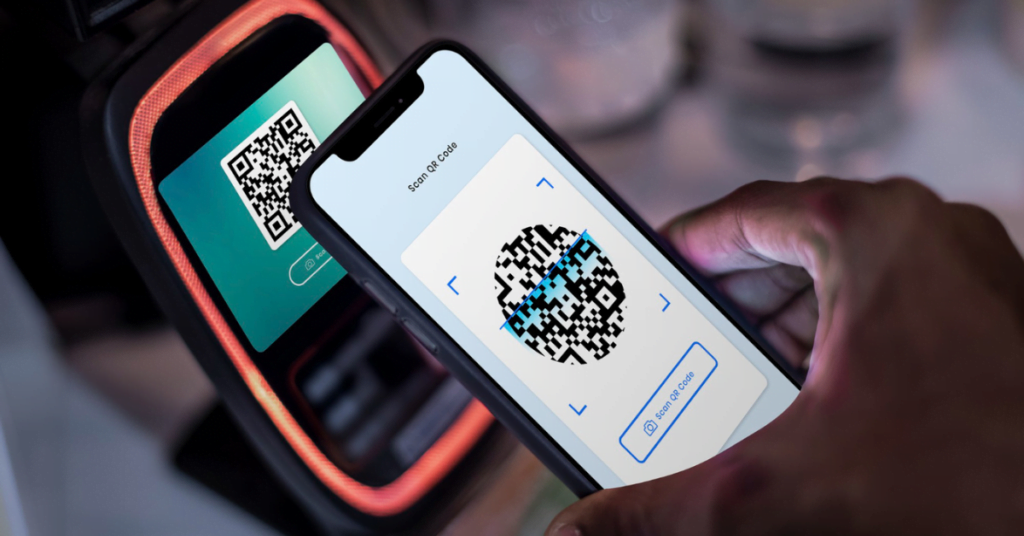

To make a transaction in digital Rupee, you’ll need the recipient’s digital wallet address or QR code.

In the e-rupee App, you will see images of notes (Rs. 500, Rs, 200, Rs. 20, etc) and coins (Rs. 1, Rs.2, etc).

These notes and coins have a unique serial number.

To finalize the amount to be sent, you will have to choose among these notes and coins.

You can initiate the transaction through your digital wallet App, enter the recipient’s wallet address, and specify the amount you’d like to send.

Step 4: Confirm the Transaction

Before the transaction is processed, you’ll be asked to confirm the details of the transaction, such as the recipient’s wallet address and the amount to be sent.

Step 5: Transaction Processing

Once you’ve confirmed the transaction, the digital Rupee will be transferred from your wallet to the recipient’s wallet.

As the digital rupee system is based on blockchain technology; the transaction will be recorded in real-time on a secure, tamper-proof ledger, and the funds should be available in the recipient’s wallet in a matter of minutes.

That’s how you can do transactions in digital rupee.

Very soon, RBI’s digital rupee transaction will be available throughout India. It would definitely offer increased financial inclusion for those without access to traditional banking services.

FAQ – Digital Rupee India

1) Do you need a bank account to do transactions in digital rupee?

Bank account is required only to add and withdraw funds from your e-rupee wallet. If you only want to receive money in your wallet, then it’s not mandatory to have a bank account.

2) How to buy a digital rupee?

You can buy or get digital rupee access from the four assigned banks – State Bank of India, ICICI Bank, Yes Bank, and IDFC First Bank.

3) What is the difference between Digital Rupee & UPI?

The major difference is that; for UPI transactions it’s mandatory to have a bank account for both the sender and receiver.

In digital rupee transactions, recipients do not need a bank account if they only want to receive money in a wallet.

4) What is the official digital currency of India?

Digital Rupee (e₹-R) is the official central bank digital currency of India.

Want to know about digital currency, RBI’s digital rupee, CBDC India –