During Union Budget 2022, Finance minister Nirmala Sitharaman mentioned that RBI would be rolling out India’s very own Digital Currency. Since then everyone is much curious about what exactly digital currency is?

What is Digital Currency?

Digital currency is any form of currency that can only be managed and accessed through a computer network or the internet. They have no physical existence like the Indian rupee, dollars, euro, coins, etc.

They only exist in the electronic form and can be accessed via phones, laptops, tablets.

Digital currency is also known as electronic money, electronic currency, digital rupee, or digital money.

Government or central authority-approved digital currencies hold equal value as physical currency. They can be used to purchase goods and pay for services by using electronic wallets (such as Google pay, Paytm, PhonePe, etc.) or computers attached to the internet.

History of Digital Currency

Digital currency first comes into existence in 1989 when David Chaum – an American cryptographer founded the first electronic money company DigiCash.

Using DigiCash, people could do transactions anonymously due to the number of cryptographic protocols applied by David Chaum.

In 1990, DigiCash created eCash to facilitate micropayment transactions anonymously. The aim was to secure the identity of the user who conducts online transactions.

Despite having an amazing concept for the time, eCash could not hold its ground and DigiCash declared bankruptcy in 1998. In 1999, David Chaum stated in an interview that DigiCash entered the market before e-commerce was fully integrated within the Internet.

After DigiCash, many other digital currencies have also come into the light from different parts of the world but could not fully take off.

In 2009, a pseudonym developer Satoshi Nakamoto founded Bitcoin which is a widely used, traded, and accepted cryptocurrency in any part of the world. This emergence again brought digital currencies in limelight.

Types of Digital Currency

Digital currency can be a centralized or decentralized one.

1) Centralized Digital Currency

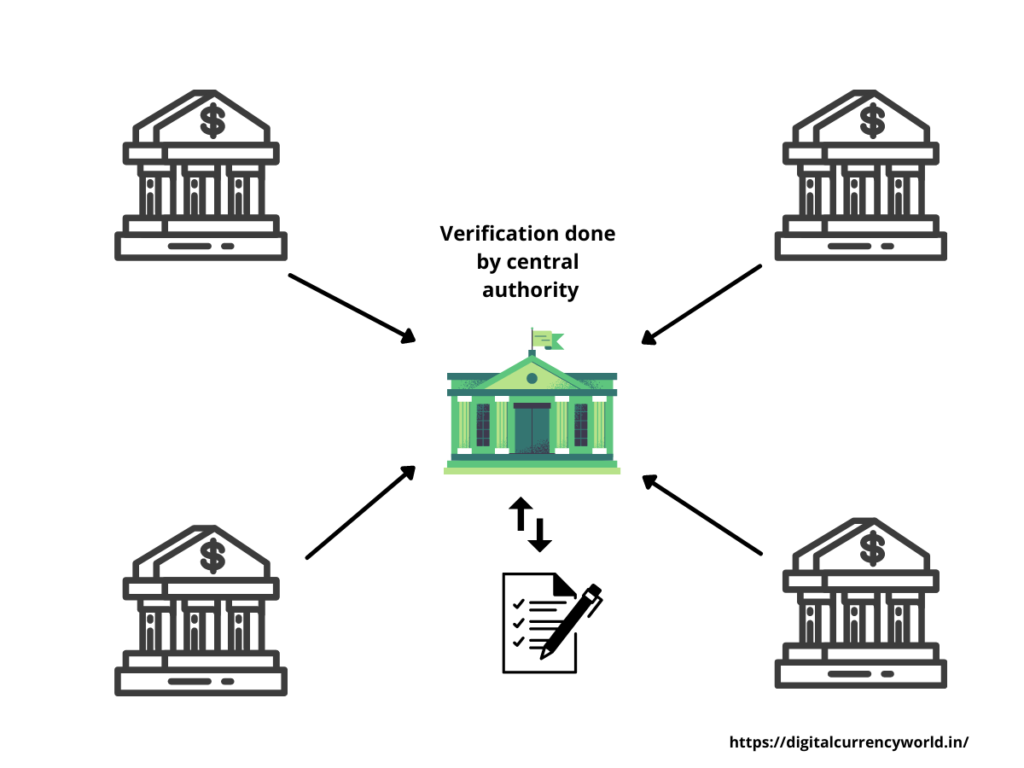

Centralized digital currencies are regulated by central banks or government agencies. All the transactions are recorded in a centralized computer database on the internet owned by the bank or the company.

The central authority has control over the distribution and supply of the centralized digital currency.

Fiat currency is one of the examples of centralized digital currency. Fiat money is the government-issued currency that is not backed by any commodity such as gold or silver.

India’s fiat money is the Indian rupee.

2) Decentralized Digital Currency

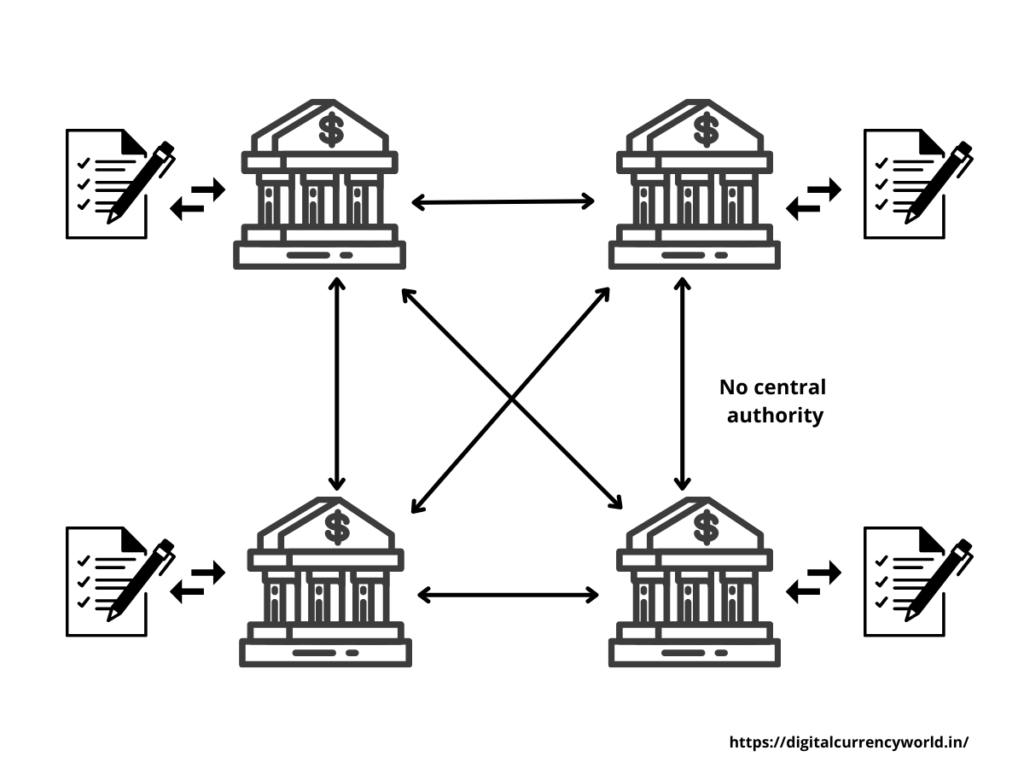

Decentralized digital currency works on a peer-to-peer (P2P) network which allows direct transaction between two parties without the interference of any central authority or third party.

This currency is not regulated by any bank or government authority. All the transactions related to ownership, issuance of a new unit, ownership transfer authorization, etc. get stored on a distributed public ledger which is encrypted by a cryptography mechanism based on Blockchain technology.

Cryptocurrencies like Bitcoin and Ethereum are well-known examples of decentralized digital currency.

Advantages of Digital Currency

Reduction in processing & distribution cost

As digital currencies have no physical existence, the cost associated with the currency manufacture, processing, distribution, and operation can be reduced.

Secure transaction

Most of the digital currencies are decentralized based on blockchain technology which offers transparent and secure end-to-end transactions.

Fastest payment with low transaction cost

During digital currency transactions, most of the time both parties exist in the same network and perform transactions without any intermediaries which reduces time and transaction cost.

In the case of centralized digital currencies also, online payment takes very little time to complete transactions compared to traditional money transactions.

24/7 accessibility

As digital currencies are only accessible through internet attached devices; we can do transactions from anywhere anytime. There are no time restrictions like we always have to face with fiat currency transactions.

Disadvantages of Digital Currency

Extreme volatile market

Most of the digital currencies are decentralized today which means they are not backed by any government or bank. Because of this reason, the pricing of such digital currencies is not stable. They can raise or drop within a moment which makes them extremely volatile.

Illegal Activities

Decentralized currency facilitates anonymous transactions through a peer-to-peer network which makes it untraceable. This feature can increase criminal activities related to money laundering and other illegal practices.

Hackers can also steal digital currencies from external digital wallets.

Uncertain future

Decentralized digital currencies are still in the development phase. These currencies do not hold any value unless you can buy or exchange something with them. So the future is uncertain as many countries haven’t accepted it as legal tender yet.

Different Forms of Digital Currencies & How it Works

There are mainly three forms of digital currency – virtual currency, cryptocurrency, and central bank digital currency (CBDC).

1) Virtual Currency

Virtual currencies are unregulated digital currencies mostly controlled by their developers or the organization which developed them. This currency can be used only in the predefined network, such as in gaming applications.

Unregulated virtual currency does not hold any value in the real world.

For example – In an online game, we can earn virtual money by finishing a particular task and then purchase a few things by using that money in the same game. But with that virtual money, we cannot buy any goods or pay for services in the real world.

2) Cryptocurrency

Cryptocurrency may be a regulated or unregulated digital currency that works on a cryptography mechanism to ensure secure transactions and maintain transparency. This cryptography mechanism is also used to manage and control the creation of such currencies.

All the cryptocurrencies are digital currencies but all the digital currencies are not cryptocurrencies.

Find out more about cryptocurrency.

3) Central Bank Digital Currencies (CBDC)

CBDC is a digital form of fiat currency issued and regulated by the central bank itself.

Central bank currencies have legal tender status and own equal value as physical money such as printed notes or coins.

India’s Digital Currency

In February 2022, while presenting the union budget, the finance minister Nirmala Sitharaman announced that the Reserve Bank of India (RBI) will soon introduce India’s first digital currency – Digital Rupee.

This central bank digital currency (CBDC) by RBI is likely to launch in the financial year of 2022-23.

Finance minister Nirmala Sitharaman also stated,

“Introduction of a central bank digital currency will give a big boost to the digital economy. Digital currency will also lead to a more efficient and cheaper currency management system”

This CBDC will be the digital version of India’s physical cash issued by the reserved bank of India.

Digital Currency FAQs

Is digital currency real money?

Central Bank Digital Currencies (CBDC) hold equal value as actual money, so we can call them real money. But decentralized digital currencies have not achieved legal tender yet, so they cannot be considered real money.

Who invented digital currency?

David Chaum had first introduced the concept of digital currency in 1989 and invented DigiCah. Later in 2009, a pseudonym developer Satoshi Nakamoto founded Bitcoin which has become insanely famous.

What is the difference between cryptocurrency and digital currency?

The main difference is that all the cryptocurrencies are digital currencies but all digital currencies are not cryptocurrencies. Fiat money is not cryptocurrency.

Are credit cards/debit cards digital currency?

Yes, credit/debit cards can be considered digital currency because it holds the money in an electronic form that carries equal value as actual money.

What is the digital currency of India?

Digital Rupee would be India’s first digital currency as stated by India’s Finance Minister.